ATTENTION: RETIREES & PRE-RETIREES!

Why Are So Many Wealthy Americans Rushing To Set Up 'Their Father's Pension'?

What's Possible...

I don’t know what I’d do without my trusted team at Personal Pension Accounts! They’ve saved me from countless hours of worry about my retirement.

Karla P.

I wish I had set up my Personal Pension Account sooner. But it’s better to plant a tree now than never!

Heather P.

I turned $50,000 into life-long income using the Personal Pension Account.

Beth I.

Status Quo Retirements Are Broken

Dear Friend,

If you're like most of our readers, you pine for your Father's Pension...

The days of:

✅ Guaranteed lifelong income

✅ Generous company bonuses

✅ No risk of your accounts going down in value

But those days are long-gone and they're not coming back.

It started in 1978 when the 401(k) was invented by Ted Benna...

Which was supposed to be a supplement for pensions, not a replacement.

Now, Americans are stuck with:

❌ No guaranteed income (not even a dime)

❌ Shouldering all of the risk

❌ Your growth & principal are not guaranteed (most retirement accounts rise and fall with the market)

Since then, savvy Americans have been searching for a better alternative that would give them access to their Father's Pension even if their company doesn't provide one...

Wealthy Americans Are Converting Their Retirement Accounts Into Personal Pension Accounts

What's a PPA?

A PPA is a little-known financial vehicle that turns your nest egg into guaranteed income for life.

The best part is, when you leverage this IRS-approved account for your retirement, you participate in market growth, but your principal is protected from all market losses.

What Are Americans Like You Doing To Prequalify for Guaranteed Life-Long Income with a Personal Pension Account?

You may prequalify for a PPA if you have an orphaned 401k / TSP / IRA from a previous employer with more than $50,000.

That could offer you guaranteed income for life (and possibly your spouse) with zero risk of stock market losses.

However, there are a few more qualifications you must meet.

To discover if you prequalify for a PPA, please complete the following:

Step 1:

Begin the suitability process by completing the brief survey below. Typically we can get 80% of your prequalification done from this questionnaire before speaking to you.

Step 2:

Schedule your complimentary PPA Suitability Review Call to review your questionnaire with your Licensed PPA Advisor and get qualified for the PPA.

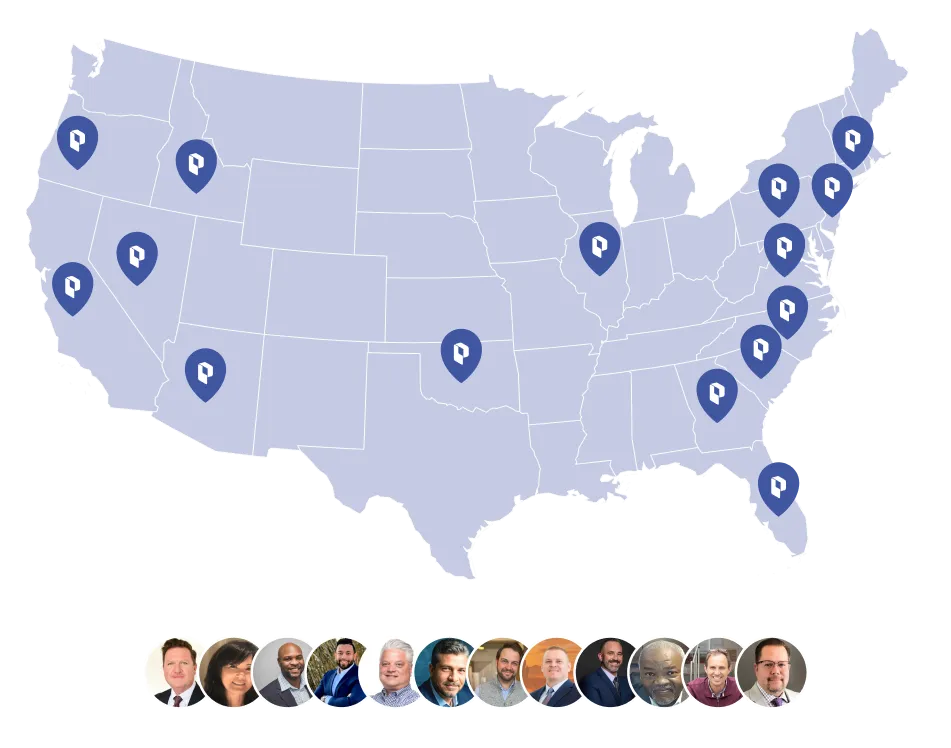

What Is A Licensed PPA Advisor?

A Licensed PPA Advisor has earned the license required by your state, which is often different than your typical financial advisor.

This allows them to work directly with Pension Managers at A-Rated Pension Companies and allows them to be certified as a Licensed PPA Advisor.

Why Should I Schedule My Complimentary PPA Suitability Review Call?

Only 30% of prequalified Americans can actually implement the PPA due to factors like the types of accounts they have, and how long they've been funding them for.

To get you fully qualified and provide a customized and personalized PPA, your Licensed PPA Advisor will need 5-15 minutes so they can determine if the PPA is suitable for you.

Similar to a mortgage, once you're pre-qualified, you need to speak with a banker.

This is no different.

Rest assured that your Licensed PPA Advisor will be the first to tell you that the PPA will not work for you.

Don't wait, and begin the suitability process by completing the brief survey below.

Take The 30-Second Pre-Qualification Survey Below:

For educational and informational purposes only. Personal Pension Accounts does not provide tax, legal, accounting, investment, or financial advice.

Personal Pension Accounts is a marketing website designed to educate consumers. It does not make product recommendations. Prospects who opt-in for more information may be referred to a state-licensed insurance agent who has paid a fee to receive the referral information. These independent agents are not employees of Personal Pension Accounts and may recommend products over which Personal Pension Accounts has no control.

All research, case studies, charts, and related content (“website content”) strictly refer to insurance products offered by a state-licensed agent. This website content does not constitute an offer to buy, sell, or exchange securities and should not be the sole basis for financial decisions. Personal Pension Accounts advertisements may reference indexed annuities, indexed universal life insurance, and other insurance-based strategies. Any guarantees mentioned are subject to the claims-paying ability of the underwriting insurance company.

Discussions in this advertisement are general in nature, based on various assumptions, and do not guarantee future performance. The appropriate type and amount of insurance depend on individual circumstances, financial situation, and needs. This advertisement is not a formal illustration of any specific life insurance policy or annuity. Terms and conditions of life insurance products are subject to change by the issuing insurer. Individuals should seek consultation with a qualified financial professional before making decisions about any recommended product.

This site is not a part of the Facebook™ website or Meta™ Inc. Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of META™, Inc.

For additional information, please review the Terms of Use and Important Disclaimers on this website.

COMMUNICATIONS:

By providing the requested information and clicking “Submit”, I provide my signature expressly consenting to contact from Personal Pension Accounts Advisor: Don Alimi at the number I provided regarding products or services associated with Personal Pension Accounts via live, automated or prerecorded telephone call, text message, or email (even if registered on the DNC).

I understand that my telephone company may impose charges on me for these contacts, and I am not required to enter into this agreement as a condition of purchasing property, goods, or services. I understand that I can revoke this consent at any time.

We take your privacy seriously and will only send you messages related to the products or services you have requested, and we will not share your mobile number with any third-party organizations. We may send messages to you at a frequency that we determine to be appropriate, but you can opt out of receiving messages at any time by replying UNSUBSCRIBE to any message. Standard message and data rates may apply.

Copyright © 2025 Personal Pension Accounts. All rights reserved.